India’s office leasing hits all-time high in 2025, surges 20% YoY to 86.4 mn sq ft: Knight Frank

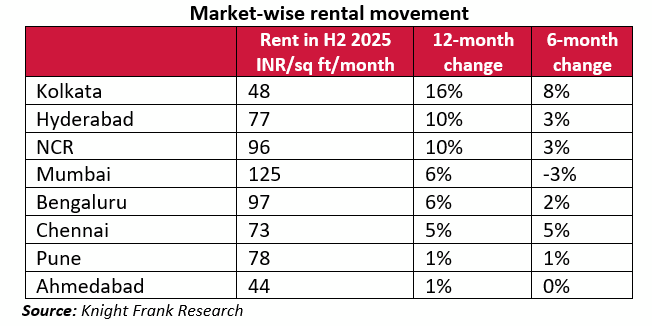

All office markets recorded rental appreciation in 2025 mostly due to low availability of quality space, led by NCR and Hyderabad with 10% growth each.

Flexible workspace operators also recorded their highest-ever annual absorption, leasing 18.6 mn sq ft, up 19% YoY. (Image: Freepik)

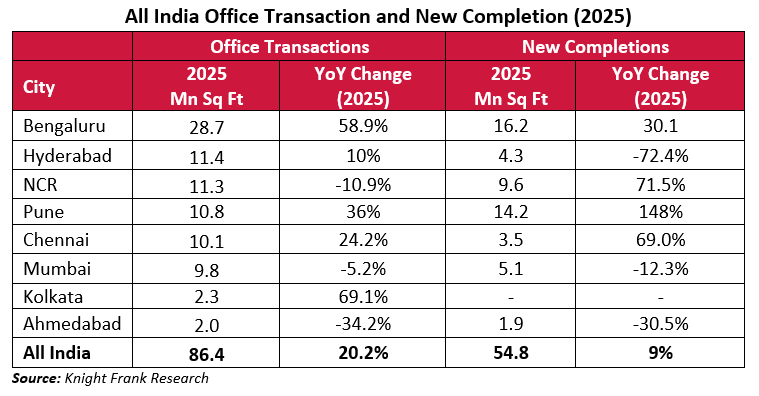

India’s office market concluded 2025 with a record-breaking performance, reinforcing its position as a clear leader among global commercial real estate markets. Annual gross leasing surged to 86.4 million square feet (mn sq ft), registering a 20% year-on-year (YoY) increase and surpassing the previous peak achieved in 2024. The scale of activity also represents a 43% rise over the pre-pandemic high recorded in 2019, highlighting the sustained expansion of occupier demand over the past four years, according to Knight Frank India’s flagship report – India Real Estate- Office and Residential Market (H2 2025) – which presents a comprehensive analysis of the residential and office market performance across eight major cities.

Bengaluru continued its dominance as the largest office market grossing 28 mn sq ft, a historic best for this market. Hyderabad (11.4 mn sq ft), National Capital Region (NCR) (11.3 mn sq ft), Pune (10.8 mn sq ft) and Chennai (10.1 mn sq ft) all crossed a 10 mn sq ft benchmark, with Mumbai (9.8 mn sq ft) narrowly missing the line. GCCs drove demand commanding 38% of the total absorption.

The strong momentum continued in the second half of the year. Leasing activity during H2 2025 stood at 37.5 mn sq ft, second only to the exceptionally high absorption recorded in H1 2025 (January – June 2025), 48.9 mn sq ft. This consistency highlights the depth of demand and the confidence with which occupiers committed to long-term real estate decisions, supported by a favourable macroeconomic environment and India’s growing role in global business operations.

Global Capability Centres (GCCs) anchored the market accounting for 38% of total annual transactions at 31.8 mn sq ft, strengthening India’s position amongst global peers as a centre of excellence in research and development and other related businesses. Flex space took up 18.8 mn sq ft representing 22% share of total gross leasing in 2025. Third-party IT services took up 15.3 mn sq ft during the year, accounting for 20% of the transacted area with its volumes growing 94% YoY.

Even while office leasing activity remained robust, new office completions could not catch up to that pace and rose by a more modest 9% YoY to reach 54.8 mn sq ft in 2025. Here too Bengaluru saw the highest volume of 16.2 mn sq ft, followed by Pune with 14.2 mn sq ft. As supply remained muted compared to leasing volumes, rents firmed up further across all markets over the course of the year. This dynamic has strengthened landlords’ pricing power, driving rental growth. All office markets recorded rental appreciation in 2025 mostly due to low availability of quality space, led by NCR and Hyderabad with 10% growth each, followed by Mumbai and Bengaluru, both registering rental increases of 6%.

Commenting on the pan-India performance, Shishir Baijal, International Partner, Chairman and Manging Director, said, “India’s office market delivered an exceptional performance in 2025, decisively surpassing its previous peak and underscoring the depth and breadth of occupier confidence across the country. With annual leasing volumes rising more than 20% year on year, the current cycle marks not just a numerical high but a structural shift in how global and domestic enterprises view India as a long-term business destination. The fact that five major markets recorded their highest-ever transaction levels, each crossing the 10 mn sq ft threshold, highlights the geographically diversified nature of this expansion. Bengaluru’s continued leadership, alongside strong performances from Delhi-NCR, Chennai, Pune and Hyderabad, reflects the maturity of India’s office ecosystem, supported by robust talent pools, resilient demand drivers and disciplined supply. This broad-based momentum positions the sector on a strong footing as it enters 2026, with sustained visibility and stability underpinning future growth.”

End-User Assessment of Office Demand

Sectoral demand remained secured by Global Capability Centres (GCCs), which leased approximately 32.5 mn sq ft during the year, representing 38% of total absorption. Bengaluru alone captured 47% (15.2 mn sq ft) of GCC leasing activity. The scale and complexity of operations undertaken by GCCs have expanded significantly, positioning India as a strategic node in global enterprise ecosystems rather than a cost-arbitrage destination. Hyderabad (5.1 mn sq ft) and Chennai (4.5 mn sq ft) were the other two markets where GCCs took up the most space during the year.

Third-party IT services staged a strong comeback in 2025, leasing 15.3 mn sq ft, a 94% YoY increase. The segment accounted for 20% of total leasing during the year supported by accelerating global adoption of AI and continued reliance on India’s deep technology talent pool.

Flexible workspace operators also recorded their highest-ever annual absorption, leasing 18.6 mn sq ft, up 19% YoY. Co-working formats dominated flex demand, accounting for 72% of total flex absorption, while enquiries for managed office solutions continued to rise as occupiers sought scalable and specialised workplace offerings.

From an asset-quality perspective, Grade A office space continued to dominate occupier preference. Such assets accounted for 91% of total leasing in 2025 and 89% during H2 2025. Occupiers increasingly prioritised modern infrastructure, operational efficiency and sustainability credentials, a trend reinforced by the growing footprint of REIT-owned portfolios and the rapid evolution of workplace strategies.

Viral Desai, International Partner, Senior Executive Director- Occupier Strategy & Solutions, Industrial & Logistics, Capital Markets and Retail Agency, Knight Frank India, added, “From a sectoral perspective, 2025 marked a decisive shift toward globally aligned demand patterns. Global Capability Centres accounted for 38% of total leasing, while third-party IT services and flexible workspaces recorded their highest-ever absorption, underscoring renewed confidence among technology-led occupiers. Bengaluru’s record 28.7 mn sq ft of leasing along with four other markets reaching historic highs are particularly significant, as large-volume markets expanding to new peaks signal not only business expansion by existing occupiers but also fresh market entry by global and domestic enterprises. This momentum is further reflected in a 22% YoY rise in average deal size to 59,799 sq ft, even as the number of transactions moderated by around 3%. Together, these trends point to a clear preference for larger, long-term commitments, highlighting evolving occupier strategies centred on talent access, operational efficiency and scalable growth.”

Five Markets set new office transaction records:

Continuing its premier position, Bengaluru recorded its historic-best office transactions of 28.7 mn sq ft in 2025 which was higher by 58.9% over 2024. Of the total transactions in the city, 63% were concluded by Global Capability Centres (GCCs). Hyderabad witnessed office leasing activity totalling 11.4 mn sq ft, a new landmark, marking an annual growth of 10%. This growth was primarily driven by increased space uptake by GCCs. While the National Capital Region (NCR) recorded third highest transaction level (11.3 mn sq ft) in 2025, but this volume was subdued by -10.9% on YoY basis. Pune (10.8 mn sq ft) and Chennai (10.1 mn sq ft) also recorded their best years in office leasing volumes.

New completions rise taking office stock over 1 bn sq ft:

Office completion was recorded at a very robust 54.8 mn sq ft registering an annual growth of 9% over 2024, with high volume markets of Bengaluru recording new office space of 16.2 mn sq ft (30.1% YoY) followed by Pune which recorded new office space of 14.2 mn sq ft (148% YoY). While new office completions grew in YoY terms, the intense demand for office space kept vacancy rates at 15.1% in 2025.

Office rental surge across markets:

Rents firmed up across all markets over the course of the year, consistently higher since 2022, as Indian landlords have been able to negotiate better terms in a market that has seen the strongest office markets struggle globally. Rents grew between 1% and 16% YoY across all markets in H2 2025 with Kolkata growing at 16% YoY while NCR and Hyderabad grew at 10% YoY each respectively.

The Indian office market gathered strong momentum in 2025, building on the breakout performance of 2024. Even as geopolitical risks continue to temper global sentiment, India has emerged as a preferred destination for global businesses, supported by stable regulations and steady economic growth. Expanding GCC activity and a sustained recovery in third-party IT services continue to anchor demand. With limited headwinds beyond supply constraints and greater adoption of retrofitting and repurposing to unlock capacity, the market is well placed to carry this momentum into 2026.