Don’t expect further rate cuts unless growth concerns aggravate: CareEdge Ratings

Given the incomplete transmission of the previous rate cuts, the RBI is expected to hold off on further easing, allowing time for the full impact of earlier measures to materialise.

Despite recent headwinds, India’s external position remains resilient. (Image: Freepik)

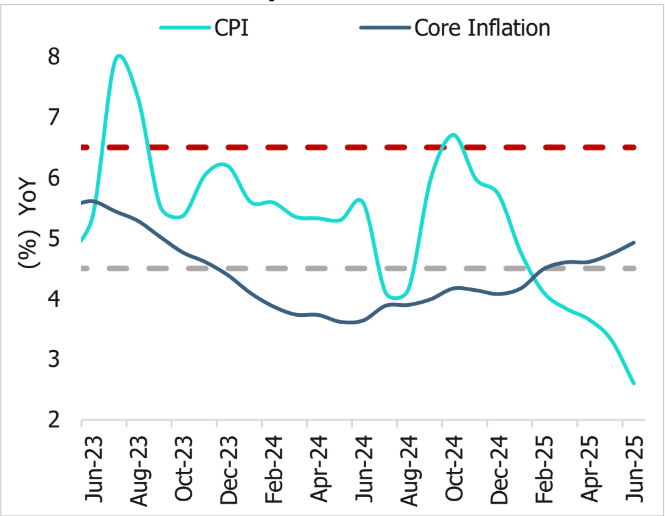

The upcoming monetary policy meeting in August takes place against the backdrop of a notable moderation in headline inflation in recent months, largely driven by easing food prices. Inflation is projected to average below the 4% target over the next two quarters, supported by a favourable base and muted food inflation. However, the headline inflation is projected to start rising from Q3 and reach above the 4% mark by the fourth quarter of this fiscal year as the favourable base effect wanes, according to a report by CareEdge Ratings.

In FY27, CPI inflation is likely to be higher at around 4.5% given the low base of FY26. As far as growth is concerned, there is likely to be some moderation in the near term. The global trade policy uncertainty will continue to cast a shadow on India’s growth outlook; however, the overall impact is likely to be limited given India’s limited merchandise trade exposure to the US economy. With the RBI having already frontloaded rate cuts and ensured ample liquidity, the MPC may prefer to pause for now and assess how the macroeconomic landscape evolves. Additionally, transmission of the previous rate cuts is still underway and could take some more time to show its effect on the economy. Moreover, a hawkish stance from the US Federal Reserve, ongoing trade tension with the US and recent appreciation of the US dollar index could provide further reasons for adopting a wait-and-watch approach, as additional pressure on the rupee may emerge. Nonetheless, “we expect the RBI’s policy statement to retain a dovish tone, while maintaining a cautious outlook on evolving global developments,” it says.

MPC to Lower Inflation Target

The CPI inflation eased further to 2.1% in June, coming below expectations and marking the lowest print since January 2019. The decline in CPI inflation was primarily driven by sustained moderation in food inflation and a favourable base effect from the previous year. Within the CPI basket, the food and beverages category entered deflation, contracting by 0.2% YoY in June. This was led by deflation in key items such as vegetables (-19% YoY), pulses (-12%), spices (-3%), and meat (-1.6%). However, double-digit inflation in edible oils (17.8% YoY) and fruits (12.6%) has narrowed the disinflation in the food basket. The persistent inflation in edible oil remains a concern, given India’s dependence on imports and elevated global edible oil prices.

Globally, the FAO Vegetable Oil Price Index rose by 18.2% YoY in June. Nevertheless, the government’s recent reduction in basic customs duty on imported edible oils, coupled with healthy kharif sowing of oilseeds, should help cushion price pressures on edible oil in the coming months. Looking ahead, food inflation is likely to remain contained, supported by healthy agricultural activity and a favourable base. The core inflation saw a slight uptick to 4.4% in June. While still within the comfort zone, this increase in core CPI is not broad-based and is mainly attributed to a rise in prices of precious metals. Excluding gold and silver, core inflation stands at 3.5%.

Inflationary Pressures Eased

On the external front, Brent crude oil prices, which had spiked due to recent conflicts in the Middle East, have since corrected. Given the demand-supply dynamics, we expect Brent crude to average at comfortable levels of ~USD 68/bbl unless geopolitical tensions play out. Similarly, the Bloomberg Industrial Metals Subindex remains at comfortable levels. Despite the subdued global demand, geopolitical tensions would continue to exert an influence on commodity price movements. Hence, it would be crucial to monitor the geopolitical tensions and trade policy uncertainties.

Overall inflationary environment is likely to remain favourable over the next few quarters. However, inflation is likely to inch up above the 4% mark in the fourth quarter of this fiscal year as the favourable base effect wanes. CPI inflation is likely to undershoot the RBI’s FY26 projection of 3.7%. Accordingly, the RBI may revise its inflation forecast downward. We expect CPI inflation to average around 3.1% in FY26. Given the low base of FY26, average CPI inflation is expected to be higher, around 4.5% in FY27.

Headwinds to Growth Remain a Concern

India’s GDP growth for the fourth quarter of FY25 stood at 7.4%. However, we expect the growth momentum to slow in Q1 FY26, and the slowdown is largely attributed to subdued performance in the mining, utilities, and manufacturing sectors, as reflected by the high-frequency indicators for the first quarter. Global trade policy uncertainties and ongoing geopolitical tensions continue to weigh on the manufacturing sector, while the mining sector feels the brunt of the early onset of the monsoon.

“We are maintaining our GDP growth projection at 6.4% in FY26. As per our estimate, the recently announced higher reciprocal tariff could dent GDP by 0.3-0.4%. However, we are not revising the projection for FY26 as yet, assuming a resolution of India’s ongoing trade tensions with the US, with a reduction in the currently announced tariff rate of 25% and penalties. The growth momentum will be supported by recent interest rate cuts, strong agricultural activity boosting rural demand, benign inflationary conditions, and a favourable monsoon. However, it will be important to monitor risks from global trade policy uncertainties closely,” says the report.

On the domestic front, the subdued income growth in the formal sector is concerning. This becomes specifically critical amid weak hiring in the IT sector. While rural demand remains steady, an improvement in urban consumption will be critical for a broad-based recovery in overall demand. Strengthening consumption is essential to unlock a more robust revival in private sector capital expenditure. In addition to tracking real GDP growth, monitoring nominal GDP growth is equally important.

Rising disinflationary pressures could potentially moderate nominal growth to around 8% in FY26. Additionally, if the wholesale price remains in deflation, it can make economic conditions appear healthier than they are when evaluated on a constant price basis.

Liquidity Conditions Remain Comfortable

Currently, the banking system liquidity surplus stood at Rs 2.7 trillion, equivalent to about 1.1% of NDTL. This is higher than the Rs 1.4 trillion surplus in April. The RBI’s liquidity injection has kept the overall banking system liquidity in surplus. The announced phased 100 bps CRR cut beginning September is expected to inject about Rs 2.5 trillion of durable liquidity into the system by December. Additionally, RBI’s record Rs 2.7 trillion dividend transfer to the Government adds to the durable liquidity, which should flow into the system as government spending remains healthy. However, some of the surplus liquidity could be offset by the unwinding of the RBI’s short forward book (~Rs 4 trillion will mature over the next 12 months).

Average systemic liquidity has remained in surplus, leading to the weighted average call rate hovering near or below the SDF rate for specific periods over these months. Surplus liquidity conditions would continue to ensure smoother transmission of the policy rates. We expect that the RBI will continue to ensure favourable money market conditions and support credit growth.

External Sector Remains Resilient Despite Headwinds

Financial markets continue to face volatility amid ongoing trade policy uncertainties and geopolitical tensions, contributing to a persistently unpredictable external environment. June and July saw Foreign Portfolio Investment (FPI) outflow of USD 0.9 billion and USD 1.2 billion, respectively. Hawkish tone of the US Fed, recent trade deals of the US with key trading partners and improvement in US growth have resulted in some strengthening of the dollar index recently (up ~3.2% in July).

Despite some signs of improvement, the global macroeconomic environment remains fragile. In its July 2025 World Economic Outlook, the International Monetary Fund (IMF) revised its global growth projections upward, forecasting 3.0% growth in 2025 and 3.1% in 2026. However, these remain below the 3.3% growth recorded in 2024, highlighting persistent weakness.

A key concern is the recent unilateral imposition of 25% tariffs—along with penalties—on Indian exports to the US, which has added considerable uncertainty. Additionally, the lack of clarity regarding penalties on imports of Russian crude oil further compounds risks. This situation is particularly worrisome given that some peer economies, such as Vietnam (20% US reciprocal tariff), Indonesia (19%), and the Philippines (19%), currently face lower tariff rates than India. The relative tariff advantage India held under the April round of announcements has now reversed.

“While we anticipate a resolution to the ongoing trade tensions between India and the US, including a potential reduction in tariffs through a negotiated deal, the continuation of current tariff levels (25%+penalties) could have a negative impact of around 0.3-0.4% of GDP,” says CareEdge Ratings.

Despite recent headwinds, India’s external position remains resilient. Foreign exchange reserves have increased by USD 55 billion year-to-date, reaching USD 695 billion as of mid-July. The current account deficit (CAD) is also expected to remain manageable, projected at 0.9% of GDP in FY26. Our projections on CAD already account for the hit to export due to external vulnerabilities, as merchandise exports are assumed to contract by ~4% in FY26.

Even if India diversifies away from Russian crude, the impact on CAD is likely to be very marginal as discounts on Ural crude have reduced compared to historical levels. On the external front, healthy services exports are positive. Moreover, service exports are so far not directly impacted by the trade war and should continue to support India’s external sector.

Way Forward

The RBI had already frontloaded the rate cuts, anticipating the moderation in inflation. Hence, “we do not expect further rate cuts unless growth concerns aggravate. While the US reciprocal tariff rate and proposed penalty are concerning, the RBI may opt to wait till we get further clarity on this front. With a forward-looking outlook, the RBI would be focusing on inflation in the quarters ahead,” says CareEdge Ratings.

With CPI inflation expected to breach 4% in Q4 FY26 and average ~4.5% in FY27, the real policy rate would settle in the range of 1–1.5% at the current repo rate. Therefore, a rate cut in the upcoming policy meeting appears unlikely. Given the incomplete transmission of the previous rate cuts, the RBI is expected to hold off on further easing, allowing time for the full impact of earlier measures to materialise.