Silver prices poised to rise 20% in a year: Emkay Wealth Management

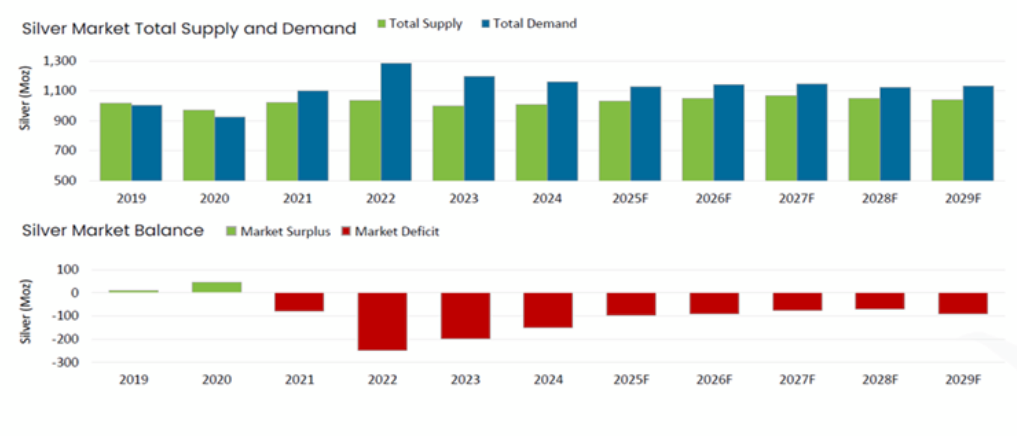

Favourable demand-supply dynamics are also supporting upward momentum in silver, which is now technically approaching an all-time breakout zone.

A favorable monsoon and improved water reserves also point towards a stronger second half of the financial year, particularly during the festive and busy season. (Source: Freepik)

Silver prices are expected to touch USD 60 per ounce in the next one year, a potential of 20% YoY from the current price level, owing to growing industrial demand. The current supply deficit to demand is currently recorded at 20%, and is expected to be in deficit for the foreseeable future, according to the latest research report by Emkay Wealth Management, the wealth management and advisory arm of Emkay Global Financial Services.

Gold returns have been on par with equities and above bonds since the end of the gold standard. In the year-to-date terms, till 8th October, gold has made a return of 61.82% whereas other asset classes such as Indian equities, bonds have registered a return of 4.2% (Nifty 500 TRI) and 8.4% (Crisil Short Term Bond Index) respectively. Prices of precious metals closely intertwined with US Dollar currency movements. The expected rate cuts in the US may lead to some decline in the dollar further providing support to price growth in gold.

Ashish Ranawade, Head of Products, Emkay Wealth Management, said, “The rising preference for gold over the US dollar among institutional investors and central banks lies at the core of the recent appreciation in precious metals. Favourable demand-supply dynamics are also supporting upward momentum in silver, which is now technically approaching an all-time breakout zone.”

Indian equity markets continue to be in the expensive zone relative to growth. Nifty 100 is valued at 21.8, Nifty Midcap 150 at 33.6, Nifty Smallcap 250 at 30.43, and Nifty Microcap 250 at 28.88.

Domestic investors continue to pour money into Indian equities

Dr. Joseph Thomas, Head of Research, Emkay Wealth Management, said, “Structurally, India is expected to be an outlier in global economic landscape. A spate of IPOs has made India a much wider market than what the indices indicate. Stock specific opportunities remain prevalent for Indian investors. We expect PMS and AIF and active fund managers should do well.”

According to Emkay Wealth, factors such as a high-growth and large domestic market, digital leadership, infrastructure push, ongoing reform momentum, the China+1 strategy, sectoral strengths, and, most importantly, geopolitically balanced strategic partnerships are expected to further propel India’s compelling growth story.

The United States, one of the largest consumer markets in the world, has imposed wide-ranging tariffs across multiple countries — creating massive disruptions in global supply chains. A stark example is the U.S. auto industry, which has been significantly impacted due to tariffs on Mexico and Canada. Traditionally, automobile components would cross the U.S.-Mexico-Canada borders nearly five to six times during the manufacturing and assembly process. The introduction of tariffs has severely disrupted this cross-border flow, amplifying costs and delays across the ecosystem.

This disruption is not limited to North America. India, too, has borne the brunt, facing some of the highest tariffs — as steep as 50% — on its exports to the U.S.

Adding to these trade frictions are the ongoing geopolitical conflicts — particularly the wars in Ukraine and the Middle East — which have deepened global polarization and forced countries to take sides. These conflicts have further strained global trade flows and supply lines that were steadily strengthening over the past two decades.

Such global-scale disruptions are unprecedented. While technological or product disruptions have often been viewed positively for fostering innovation, this time the world is witnessing a macro-level disruption that is reshaping global trade and growth dynamics.

Despite these challenges, the International Monetary Fund (IMF) has maintained that the overall impact on global growth in calendar year 2025 will be moderate — approximately 0.5 percentage points. This relative resilience is attributed to strong domestic demand in key economies like China, India, and Saudi Arabia.

For India, growth is projected at 6.2–6.3% for 2025 and 2026, supported by a robust domestic economy. While growth could have been stronger without the imposition of steep tariffs, several factors continue to bolster India’s momentum:

Supportive Budget Measures: The government has injected additional spending capacity into the hands of consumers.

GST Rationalization: Recent GST cuts have made goods more affordable, spurring higher consumption volumes.

Easing Interest Rates: With global interest rates expected to trend lower, borrowing and investment activity are likely to improve.

India’s growth trajectory has been steady, averaging between 6.5% and 8.5% post-FY22, and remains underpinned by healthy macro fundamentals. A favorable monsoon and improved water reserves also point towards a stronger second half of the financial year, particularly during the festive and busy season.

The resilience of the Indian economy is further reflected in its Manufacturing and Services PMI, which touched a 15–17-year high in August 2025 — signaling sustained expansion in both industrial and service sectors.