RBI’s rate pause lifts buyer confidence, aids long-term real estate growth

After a series of rate cuts over the past year, the RBI move signals confidence in the broader economic outlook while ensuring that the momentum created by lower borrowing costs is not disrupted.

Experts note that maintaining the current rate will help preserve the positive sentiment created by earlier cuts, without adding inflationary pressure or market volatility.

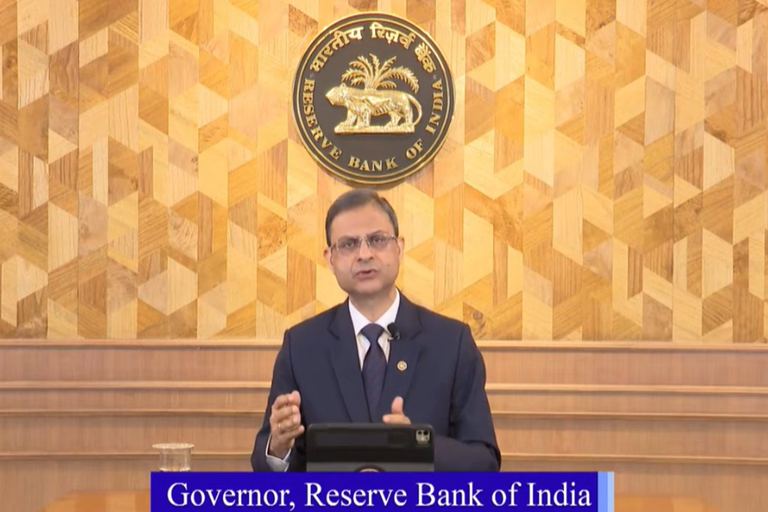

The Reserve Bank of India’s decision to keep the repo rate unchanged at 5.25 per cent has been welcomed by the real estate sector, with developers and industry experts calling it a timely and necessary step to sustain growth and market stability.

After a series of rate cuts over the past year, the RBI move signals confidence in the broader economic outlook while ensuring that the momentum created by lower borrowing costs is not disrupted. Sector stakeholders believe that policy continuity at this stage will help both homebuyers and developers plan their investments with greater certainty.

Over the last year, the RBI reduced the repo rate from 6.50 per cent to 5.25 per cent, leading to a noticeable decline in home loan interest rates. This easing cycle played a key role in improving housing affordability, reviving end-user demand, and strengthening investor sentiment across residential and commercial segments.

Experts note that maintaining the current rate will help preserve the positive sentiment created by earlier cuts, without adding inflationary pressure or market volatility. Stable interest rates are also expected to support steady sales velocity, faster project execution, and improved cash flows for developers.

Overall, the RBI’s calibrated approach is being viewed as a balancing act between growth and stability, reinforcing confidence in the real estate sector as a long-term growth engine of the Indian economy.

Repo Rate Movement Over the Last Year

| MPC Meeting / Month | – Repo Rate (%) | – Change |

| February 2025 | 6.25 | −0.25% |

| April 2025 | 6.00 | −0.25% |

| June 2025 | 5.50 | −0.50% |

| August 2025 | 5.50 | No change |

| October 2025 | 5.50 | No change |

| December 2025 | 5.25 | −0.25% |

| February 2026 | 5.25 | No change |

Buyers’ confidence will increase

Dinesh Gupta, President of CREDAI Western UP, said, “Keeping the repo rate stable is a significant step of boosting confidence of buyers. When there is no fear of sudden changes in interest rates, customers make home-buying decisions with confidence. This maintains stable and sustainable demand in the market.”

Suresh Garg, CMD, Nirala World, said, “Maintaining stable interest rates in the market after a balanced budget is a positive decision for the real estate sector. This will eliminate the fear of unnecessary fluctuations in the market for both buyers and investors. Maintaining market stability is crucial for the full impact of the repo rate cuts and GST reductions implemented over the past year to be realized in the real estate sector.”

Decision will help boost employment

Atul Vikram Singh, Founder of Vision Business Park, said that the real estate sector has a direct impact on employment. This decision by the RBI will also prove positive for the construction, steel, cement, and other allied industries.

Himanshu Garg, Director of RG Group, said, “The full benefit of the interest rate reductions seen in recent times is yet to be realized. The decision to keep the repo rate stable will give that impact time to materialize and will help housing demand grow in a balanced manner.”

Planning and Investment Will Increase

Lt. Col. Ashwani Nagpal (Retd.), COO, Diligent Builders, said that the stable repo rate will maintain stability in home loan EMIs, allowing people to plan and invest for the long term. This decision brings relief, especially for the middle class and first-time homebuyers, and will play a significant role in bringing stability to the market.

According to Shailendra Sharma, Chairman, Renox Group, policy stability is crucial for capital-intensive sectors like real estate. This decision by the RBI is an attempt to control unnecessary volatility in the market and to strike a balance between growth and inflation by the policymakers.

Rakesh Singhal, Founder, Shree KB Group, believes that this decision sends a message that the Indian economy is moving forward on a strong foundation. Stability in policy increases the confidence of both investors and consumers.

It will help in better planning

According to Pankaj Jain, Director, KW Group, “Stability in interest rates provides ease in financial planning for developers. This improves project timelines and ensures timely delivery to customers.”

Dinesh Jain, MD, Exotica Housing, believes that this time, the stable repo rate will strengthen not only residential but also commercial real estate, as it will increase the confidence of retail and institutional investors and give impetus to new projects.

Balanced Approach

E Lakshminarayana Reddy, Founder & CEO, EARA Group, said: “By holding the repo rate at 5.25%, the RBI has chosen caution over disruption, which is a sensible move at this stage of the economic cycle, especially as inflation remains within the comfort range. For real estate developers, consistency in borrowing costs is often more valuable than short-term rate cuts, as it enables long-term project execution and disciplined capital deployment. The neutral stance also signals that future policy actions will remain data-driven, giving both investors and homebuyers the confidence to take informed decisions. This environment supports steady housing demand, particularly in end-user–driven markets, rather than speculative growth.”

Pawan Gupta, Founder, FarmlandBazaar, said, “The Reserve Bank of India’s decision to reduce the benchmark repo rate by 25 basis points to 5.25% reflects a balanced approach to supporting growth while managing inflation. For the real estate sector, this policy clarity strengthens buyer confidence and improves predictability in borrowing costs, creating a supportive environment for sustainable development across residential and commercial markets.

At FarmlandBazaar, we see this as an important window for families to transition toward productive, professionally managed natural capital. With improving affordability and stable financing conditions, this is an opportune time to secure long-term land assets that offer both utility and value appreciation.”

Benefits for the real estate sector from the unchanged repo rate

* No immediate increase in home loan interest rates

* Strengthened confidence among end-user buyers

* Relief for the middle class and first-time homebuyers

* Easier financial planning for developers

* Boost to new residential and commercial projects

* Support for construction and related employment sectors