PE in Indian real estate down 15% over H1 FY25, deal sizes holding: ANAROCK Capital Flux

MMR and Kolkata, followed by Chennai, witnessed a sharp rise in activity, while pan-India / multi-city transactions took a back seat in H1 FY26.

The share of top 10 deals in H1 FY26 has declined to 77% compared to 93% witnessed in H1 FY25.

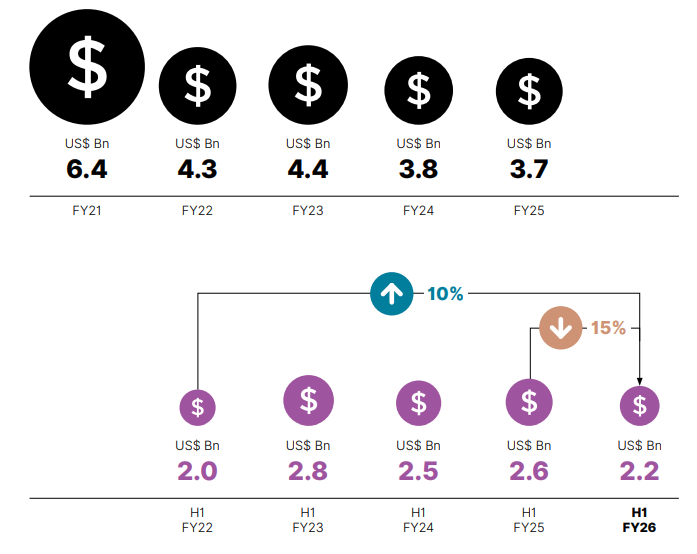

Amid a declining trend of private equity investments in Indian real estate, overall, private equity (PE) activity in the sector continued to remain soft on an aggregate basis in H1 FY26, finds ANAROCK Capital’s latest edition of FLUX.

Shobhit Agarwal, CEO – ANAROCK Capital, says, “A stronger deal showing in Q1 FY26 appeared to present a glimmer of hope, though it was short-lived as activity subsided again going into the second quarter. When viewed on a full year basis, PE activity has been on a steady decline from the high of USD 6.4 Bn seen in FY21 to USD 3.7 Bn in FY25.”

“While it is tempting to look at the H1 FY26 tally of USD 2.2 Bn with positivity, it bears keeping in mind that overall activity for H1 FY26 is down 15% on a Y-o-Y basis, compared to H1 FY25,” adds Agarwal.

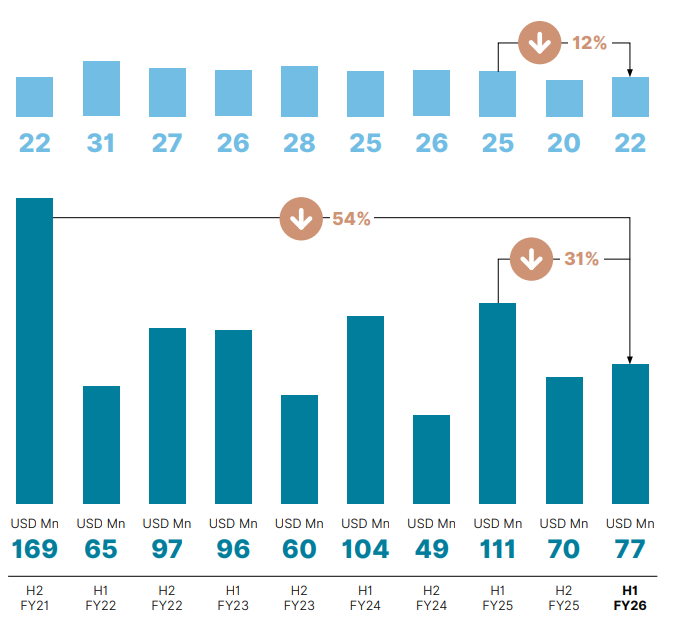

Fewer Transactions → Decline in Overall Activity

While average deal values have remained rangebound at lower levels of USD 60 Mn – USD 100 Mn, lower numbers of transactions, has been the key drag on the overall deal values.

Share of Top 10 PE Deals (YoY)

“The share of top 10 deals in H1 FY26 has declined to 77% compared to 93% witnessed in H1 FY25,” says Aashiesh Agarwaal, Senior Vice President – Research & Investment Advisory – ANAROCK Capital. ”While we do witness an outsized transaction each year, FY25 had a particularly large transaction involving Reliance Group & ADIA-KKR.”

Share of Top PE Deal in Overall Deals

FY24 & FY25 witnessed an outsized deal each accounting for 37% & 42% of the total deal value, compared to 15%-17% witnessed in FY23 & FY22. Unless we see another outsized transaction in FY26, this fiscal year might see a more evenly distributed deal table compared to witnessed in the recent few years.

Movement of Capital

MMR and Kolkata, followed by Chennai, witnessed a sharp rise in activity, while pan-India / multi-city transactions took a back seat in H1 FY26. MMR deal tables were boosted by the Kanakia-Hines-Mitsubishi-Sumitomo deal, while Kolkata saw a prominent deal in the sale of the South City Mall to Blackstone, where ANAROCK was the transaction advisor.

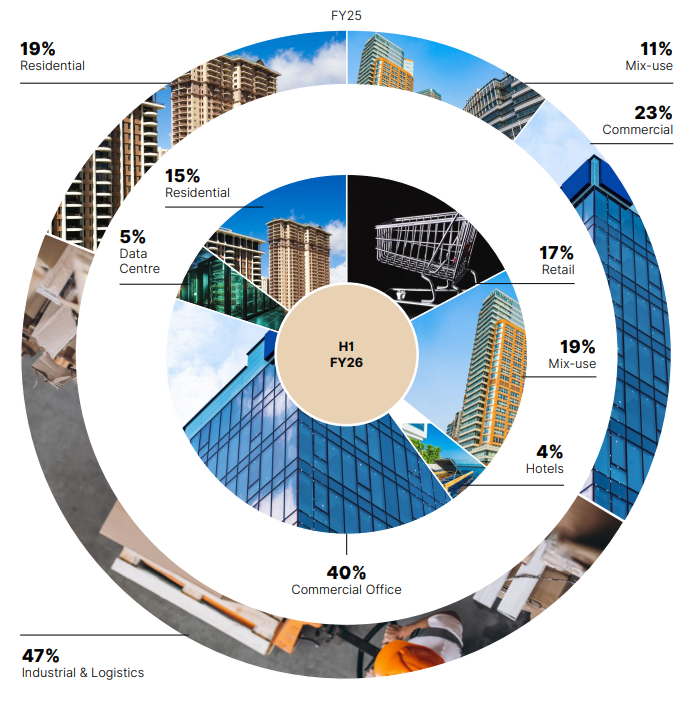

Asset Class-wise Funding

Favored segments in H1 FY26 looked dramatically different from those seen in the previous year. Industrial & Logistics was conspicuous by its absence, while the Retail, Mixed-use & Commercial asset classes registered a strong presence. Hotels and Data Centres also made an impact in the current half-year.

Equity vs. Debt Funding

Equity deals comprised 78% of all deals in H1 FY26. This is in line with the usual mix witnessed in the past, barring FY25 which witnessed an outsized hybrid transaction.

Key Real Estate Highlights H1 FY26

Residential

Residential real estate continued its phase of consolidation into the period, with launches and new sales declining. Investor interest and activity remained buoyant in the sector, with appetite for equity deals – which was missing until recently – also seen. India’s position as the world’s fastest growing large economy, shifting lifestyle preferences, and the increasing formalization of its residential real estate sector will keep investor interest in this space high.

Commercial

Leasing momentum remained robust, led by GCCs and co-working places. Expectedly, deal activity also picked up, with USD 869 Mn of offices being transacted in H1 FY26, compared to an average of USD 417 Mn transacted in the three preceding half-year periods. Investor interest in the space is expected to remain buoyant, driven by strong demand.

Industrial & Logistics

H1 FY26 saw no institutional transactions in the segment, but interest amongst institutional buyers remains high for quality assets, driven by India’s consumption story, 3PL, and e-commerce boom. Several transactions are currently under discussion, and some are likely to be closed in the coming months.

Retail

Retail real estate continued its strong run. Robust operating financial performance drove 2 large retail transactions in this half–year period – one by Nexus Select, and the other by Blackstone. India’s consumption boom will keep investors excited about its retail real estate prospects.

REITs

The last 6 months for India REITs have been eventful. In this period, REIT stocks have rallied strongly, with capital appreciations ranging between 15- 27%. TTM distribution yields have remained resilient, ranging between 5- 6%.

H1 FY26 also marked the successful listing of India’s 5th REIT – Knowledge Realty Trust – which was oversubscribed ~12.5 times overall. The period also witnessed key REIT transactions:

* Mindspace REIT concluded their 1st third-party acquisition – Q-City Hyderabad – with 0.81 Mn sf GLA for a gross acquisition price of INR 4,960 Mn (INR 6,130/sf).

* Nexus REIT concluded acquisition of MBD Complex in Ludhiana (~0.3 Mn sf urban consumption center, and a 96-key Radisson Hotel) for an enterprise value of INR 5,310 Mn.

* Embassy REIT entered binding documents with a third party for divestment of ~0.4 Mn sf strata owned blocks at Embassy Manyata for INR 5,300 Mn.

Finally, SEBI’s recent reclassification of REITs as Equities from Hybrid has boosted investor confidence and paved the way for higher institutional participation. Backed by strong occupancies and growing demand, the outlook for India REITs is very positive.