India’s hotel industry set for stable FY26 as RevPAR growth moderates

While occupancy rates in FY26 are likely to be supported by business events and leisure travel, they are likely to be dampened by potential economic slowdowns if the trade wars were to prolong.

Foreign tourist inflows remain subdued, but the mid-market segment is poised to benefit from a sustained domestic travel demand. (Image: Freepik)

India Ratings and Research (Ind-Ra) expects India’s hotel industry to see revenue per available room (RevPAR) leveling off in FY26, after showing robust growth in FY25. While occupancy rates in FY26 are likely to be supported by business events and leisure travel, they are likely to be dampened by potential economic slowdowns if the trade wars were to prolong.

The growth in FY25 was supported by a sustained demand across the business and leisure segments throughout the year, which was majorly benefited by the Maha Kumbh event in 4Q. Foreign tourist arrivals in India remain below the pre-covid highs and contrary to other Asian travel markets including Thailand, Japan and Vietnam.

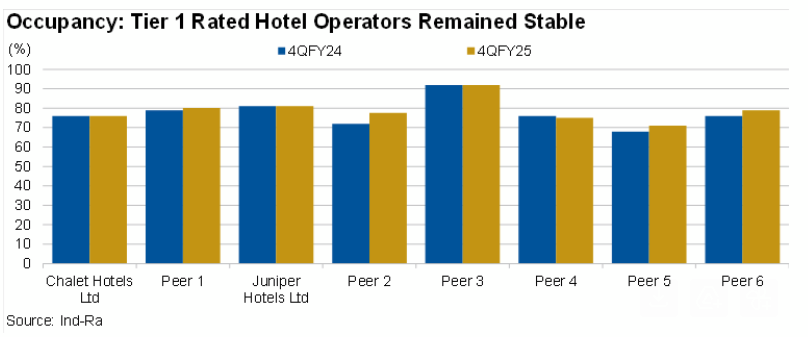

Ind-Ra peer-set hotel companies had weighted average occupancy rates of 73.5% in FY24, which increased 2% yoy to 75.5% in FY25. The agency expects the supply from tier 1 players to continue to improve at 10%-12% annually, to keeping up with demand. However, given the strength of balance sheets and mix of asset-lite supply strategy, room addition is unlikely to substantially increase the leverage intensity of the peer-set.

“The hospitality sector saw a notable revenue boost in 4QFY25, possibly driven by the Maha Kumbh event, which led to a sharp yoy surge in the average room rates. While occupancies also improved, the growth was predominantly ARR-led, with some peer companies even reporting negative occupancy trends over 9MFY25, highlighting the possibility of one-off nature of recent gains. Foreign tourist inflows remain subdued, but the mid-market segment is poised to benefit from a sustained domestic travel demand. In the current geopolitical climate, the mid-market segment appears relatively resilient. Moreover, strong balance sheets across the industry are expected to support ongoing capital expenditure plans,” said Mahaveer Shankarlal Jain, Director, Corporate Ratings, Ind-Ra.

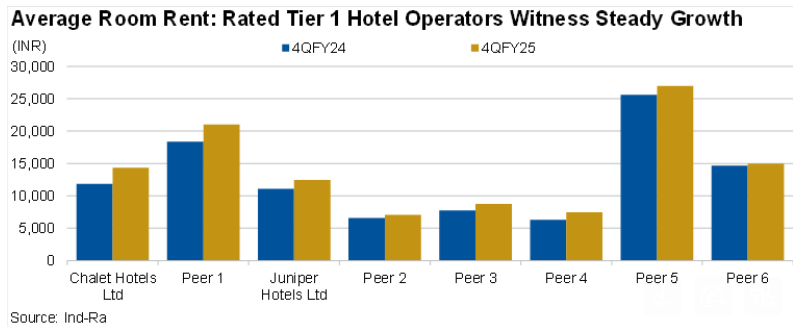

Five-star ARR Witnesses Growth: The agency observes the rated Tier 1 hotel operators’ revenue growth is largely attributed to ARR which grew nearly 11% yoy and 7% yoy in 4QFY25 and FY25, respectively. This growth is attributed to strong pricing power and limited new supply in key urban markets, amid the Maha Kumbh event in 4QFY25. The five-star deluxe hotels segment saw a notable increase in ARR in 4QFY25; Chalet Hotels Ltd (debt, rated at ‘IND AA-’/Stable) led reported the highest growth at 21% yoy, followed by Juniper Hotels Limited (debt, rated at ‘IND AA-’/Stable) at 12% yoy. These gains reflect the premium operators’ ability to command higher rates than mid-market operations amid a demand-supply mismatch. The mid-premium segment saw a consistent performance in FY25 with ARR increasing 7% yoy in ARR, with cohesive growth in the sector demand. Hotels based out of Mumbai followed by New Delhi have reportedly been the best performers.

Steady Occupancy Levels: Occupancy remained stable for all players at up to 1% yoy, except 6% yoy growth witnessed in case of Lemon Tree Hotels Ltd in 4QFY25 and a minor dip of 1% yoy for Juniper Hotels Ltd in FY25. Lemon Tree Hotel has benefitted from its increased penetration in Tier 2 and Tier 3 cities and improved brand recognition while Juniper Hotels had to undergo a renovation activity in one of their main properties. Five-star hotel operators have shown a consistent performance, maintaining high occupancy rates due to a stronger demand from business travel and MICE (meetings, incentives, conferences, and exhibitions) than from leisure travel. Premium hotel occupancy increased 3% yoy to 79% in 4QFY25. The occupancy for FY25 has been calculated by taking weighted average based on operational number of keys. A marginal increase has been noted in the operational number of keys, being a positive indicator of increasing confidence in market demand.

Strong RevPAR, Near Peak: The peer-set saw a notable increase in RevPAR in 4QFY25 due to increase in domestic leisure travel, corporate bookings, and festive season demand. Supply grew at a modest rate compared to demand, leading to a favourable demand-supply mismatch, allowing operators to capitalise on higher prices. Chalet Hotels and Juniper Hotels demonstrated steady growth of 21% yoy and 14% yoy, respectively, in 4QFY25. 4QFY25 and FY25 saw a 16% yoy and 12% yoy increase, respectively, in 4QFY25 driven by escalated ARRs, strong occupancy levels and sustained pricing power. This suggests that the sector is approaching a cyclical high, but fundamentals remain strong enough to support continued growth.

Gross Debt to EBITDA Improving: The sector’s liquidity and leverage metrics improved in FY25, on back of strong cash flows amid elevated capex levels. For the peer set, the gross debt to EBITDA ratio improved to 1.85x in FY25 from 2.65x in FY24, indicating stronger earnings capacity than the rise in debt and improved financial health. The peer-set’s EBITDA grew 26% yoy whereas the gross debt fell 12% yoy in FY25. The sector has also seen an increase in asset-light expansion strategies, such as management contracts and franchise models, which limit debt-funded capex.

The Indian hotel sector continues to show healthy growth momentum, with overall stable occupancy, ARRs, and improving leverage, pointing to stable growth into FY26, despite FY25’s high base-effect. However, the growth could moderate if macroeconomic uncertainties, such as global trade tensions or geopolitical developments, begin to weigh on corporate travel and foreign tourist arrivals remaining tepid. The mid-market operators could become more resilient due to strong trends in growing leisure travel, and higher ARR of premium operators may also encourage downgrades to mid-market accommodations.