India to outpace G7 in GDP growth by 2030: Equirus Report

The report urges investors to re-evaluate traditional portfolio models like the 60/40 split in the wake of rising global uncertainty, inflation volatility, and changing economic leadership.

The report analyses the resilience of Indian markets in the face of recent global turmoil and the importance of Asset Allocation in times of uncertainty. (Image: Freepik)

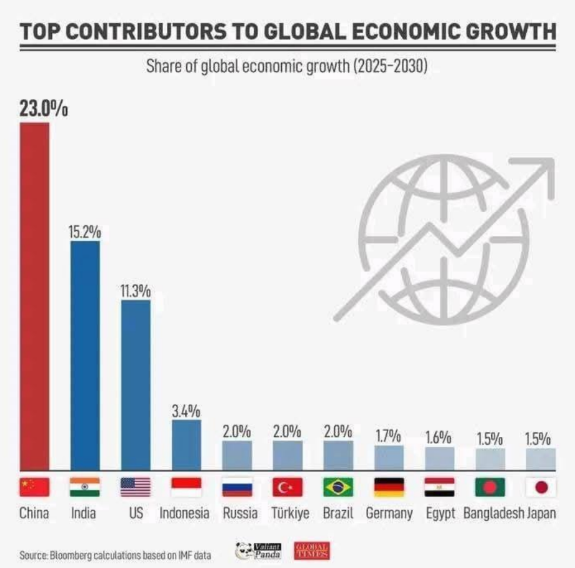

India is projected to contribute over 15% of global GDP growth between 2025 and 2030, outpacing major G7 economies like Germany and Japan, according to a new report released by Equirus, a leading multi-family and private wealth office managing ~$2.2 billion in assets across HNIs, Ultra HNIs, and mass affluent clients.

The report titled “India to Outpace G7 – Can Domestic Resilience Outpace Global Volatility? Decoding Wealth, Asset Allocation, and Market Strategy in 2025” analyses the structural macroeconomic shifts currently underway and urges investors to re-evaluate traditional portfolio models like the 60/40 split in the wake of rising global uncertainty, inflation volatility, and changing economic leadership. The study argues that the traditional “60 percent equities / 40 percent bonds” portfolio is increasingly unfit for today’s high correlation, high volatility environment and urges investors to rebuild asset allocation models around India’s multi engine growth story.

The report analyses the resilience of Indian markets in the face of recent global turmoil and the importance of Asset Allocation in times of uncertainty.

Mitesh Shah, CEO at Equirus Credence Family Office said, “The global macro regime is shifting — US growth has been revised down sharply, DXY has corrected ~6% from 2025 highs, while India is projected to contribute 15%+ to global GDP growth (2025–2030). India is benefiting from structural trends: rural FMCG demand outpacing urban (6% vs 2.8%), policy-led capex rising 17.4%, and ₹2.5 lakh crore liquidity infusion underway. Traditional 60/40 portfolios are breaking down — in 2022, the S&P 500 fell –18.1%, US bonds –13%, with correlations turning positive amid inflation shocks. In this new regime, strategic asset allocation across geographies and growth cycles.”

India > G7: Shifting Global Macro Order – US stumbles, Asia rises — Asset allocation is your edge in the chaos

The world’s economic center of gravity is in flux. In the past month alone, we’ve seen two significant macro shifts:

• In the United States, economic growth expectations have been sharply revised downward. Trade uncertainty under the new administration has triggered volatility across equities, rates, and the dollar.

• In contrast, Germany’s decision to unleash a strong fiscal impulse has raised growth expectations across the Eurozone. China, too, is seeing a modest pickup.

This marks a departure from the long-standing narrative of US exceptionalism. We are now entering an era of more balanced and unpredictable global growth, with the US no longer guaranteed to lead.

At the same time, the strength of the US dollar, which has long been a double-edged sword, seems challenged. Recent analysis from Deutsche Bank indicates that the USD needs to depreciate by ~40% to eliminate the US trade deficit entirely. While we may not agree on the absolute number as such, but we are aligned on the direction – the Dollar Index (DXY) has retreated roughly 6% from its 2025 peak.

Global crude oil remains stable, hovering around $70 per barrel. This combination — a softer dollar and manageable energy costs — bodes well for importing economies like India.

Specifically for Indian companies, it could mean margin expansion of 100–150 basis points in sectors like industrials, autos, and textiles. For investors, this could translate into sustained high multiples, underpinned by macro tailwinds.

Another, most argued narrative is ‘China +1’, the idea that companies would diversify supply chains away from China. But the data tells a more nuanced story. Despite policy intentions, China’s trade surplus has doubled in the last five years. Its dominance in scale, logistics, and technology remains formidable.

Though, cracks have started to emerge (countries like India taking smaller leads); however, the story seems more narrative and less of reality presently.

Indian policy and industry are taking initial strides to capture supply chain realignments previously dominated by China. Apple’s announcement to shift all iPhone assembly for the US from China to India by 2026 seems a good structural start. The reasons are clear: labor in India is roughly half as expensive, and workforce attrition is far lower. Add to this India’s geopolitical alignment and policy stability, and the manufacturing baton is slowly but surely being passed.

The positives emerging from the changing world order is the next decade will not be led by the traditional G7 economies — at least not in terms of contribution to global GDP.

Between 2025 and 2030:

• India is projected to account for over 15% of global incremental growth.

• In contrast, Japan will add less than 1%, and Germany just over 1.3%.

• Even Bangladesh is expected to contribute more than Japan.

This is not just a trend — it’s a tectonic shift. For global corporations and investors, India is no longer optional. It’s a risk to ignore it.

Domestically, good news is emerging from the rural segment which was facing long drawn concerns around slowing growth. Growth which was often been thought of as urban-led — driven by cities, IT parks, and metros, has seen a flip in the trend. Rural consumption is now rising faster than urban — 6% vs. 2.8% in FMCG demand growth. The inequality gap is narrowing. The Gini coefficient has improved for both rural and urban areas, signalling broader participation in economic growth.

Moreover, the gap in monthly per capita expenditure between rural and urban households has shrunk from 84% to just 70% over a decade. For the first time in years, India’s villages are not just catching up — they are leading in demand.

Another positive for India is emerging from the policy side; amid global tightening, India stands out for its policy agility. While many advanced economies remain constrained, India has launched a synchronized monetary and fiscal easing cycle:

• The government, which accounts for 28% of GDP through spending, is ramping up capital expenditure.

• Post-election, central and state capex are expected to grow by 17.4%.

• RBI has delivered a massive ₹2.5 lakh crore in liquidity via phased CRR cuts.

• GST revenues are already showing strength, with 12.6% growth in Jan–Feb 2025.

This is a rare moment when India is firing on all cylinders — consumption, capex, policy, and external tailwinds are all aligned.

Asset Allocation Strategy: Rewriting the Old Playbook?

For decades, the 60/40 portfolio — 60% equities and 40% bonds — was the gold standard for diversification. But in today’s regime, it’s breaking down.

In 2022, both US stocks and bonds crashed — S&P 500 down 18.1%, bonds down 13% — the worst 60/40 performance since 1937.

Inflation, policy resets, and rising correlation have rendered traditional diversification strategies less effective. Historical precedent — from 1929 to 2013 — shows multiple periods where equities and bonds offered zero real return for years.

As the global economic engine sputters and traditional correlations break down, asset allocation has become the single most important decision for capital preservation and compounding. The strategies of the past — anchored in US dominance, China-centric supply chains, and a stable 60/40 diversification model — are increasingly unfit for the volatility of this decade.

We are not in a cycle; we are in a regime shift.

• The positive correlation between stocks and bonds means investors can no longer rely on traditional hedges.

• Inflation volatility, policy unpredictability, and geopolitical fragmentation have created a market where passive allocations and index-heavy exposures may underperform for years.

• Diversification must now be redefined — not by asset class alone, but by geography, policy positioning, and structural growth potential.

Why This Matters Now

As global growth enters a multipolar era and correlations across asset classes rise, Indian investors must adopt a “regime-aware” asset allocation strategy — not just diversify by asset class, but by country, policy exposure, and structural drivers of growth. The report outlines how India’s evolving economic architecture — from rural consumption and fiscal strength to manufacturing gains and energy cost stability — positions it as a core allocation in global portfolios.