ICICI Prudential Nifty Private Bank Index Fund launched – Check details

This scheme offers investors an opportunity to invest in a basket of India’s private banks, which have delivered fundamentals and supported India’s economic expansion.

The Nifty Private Bank Index selects the top 10 private banks from the Nifty 500 based on free-float market capitalisation. (Image: Freepik)

ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Nifty Private Bank Index Fund, an open-ended index scheme replicating the Nifty Private Bank Index. This scheme offers investors an opportunity to invest in a basket of India’s private banks, which have delivered fundamentals and supported India’s economic expansion.

Commenting on the launch, Abhijit Shah, Chief Marketing and Digital Business Officer at ICICI Prudential AMC, said, “Through this product, we offer investors a unique opportunity to access the strength of India’s private banking sector in a simple, cost-effective manner. These banks have demonstrated high profitability, robust asset quality, and capital adequacy, making them a potential long-term investment.”

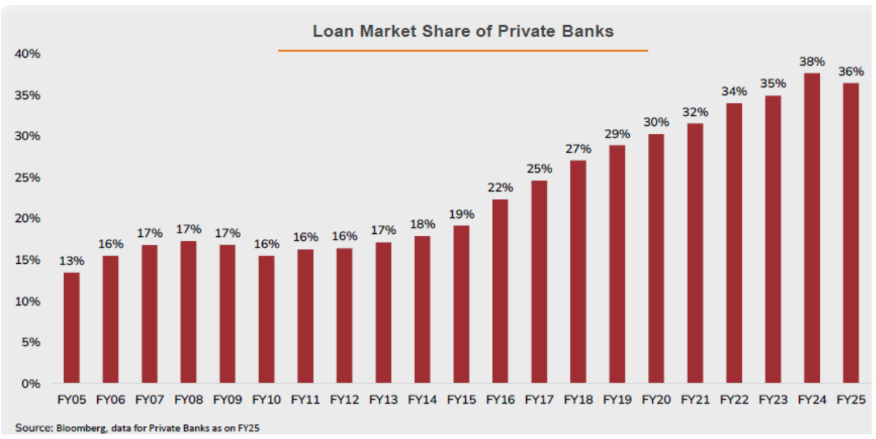

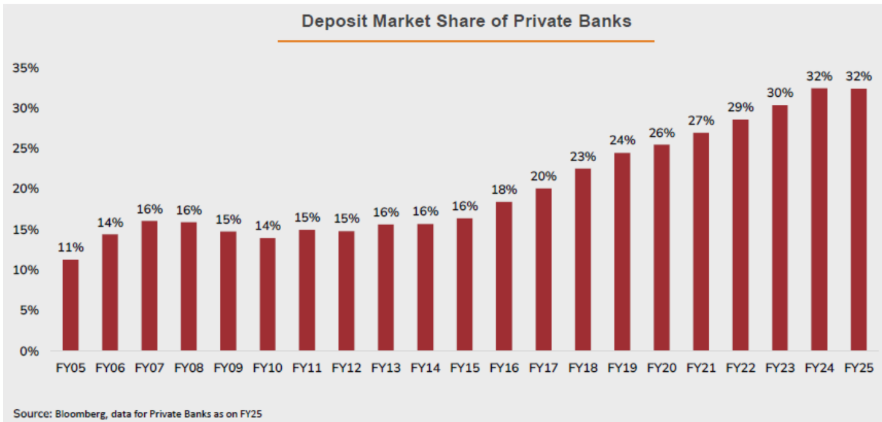

Private banks have shown growth in their share of the Indian credit and deposit markets over the past two decades. Loan market share rose from 13% in FY2005 to 36% in FY2025, and deposit market share improved from 11% to 32% over the same period.

The Nifty Private Bank Index has outperformed the Nifty 50 TRI over several rolling periods, delivering a 3-year CAGR of 19.7% versus 18.5% for the Nifty 50 TRI.

Additionally, private banks currently trade at a more reasonable P/E ratio of 17.6 compared to the Nifty 50’s 22.3, with a lower P/B ratio of 2.4 against 3.6, offering relatively attractive valuations.

Key Features:

Index Methodology: The Nifty Private Bank Index selects the top 10 private banks from the Nifty 500 based on free-float market capitalisation. Each stock is capped at the lower of 23% or a combined 62% for the top three constituents during each semi-annual rebalance.

Strong Fundamentals:

• Net Interest Income (NII) and Net Interest Margin (NIM) have steadily improved from ₹50,000 crore in FY2005 to nearly ₹400,000 crore in FY2025 with NIM rising to 4.6%.

• Capital Adequacy Ratios remain well above regulatory requirements, at 17.29% in FY2025.

• Net Non-Performing Assets (NPAs) have declined to a 10-year low of 0.50% in FY2025.

Why Invest in This scheme?

* Direct Exposure: Invest in India’s top private banks, one of the driver of the economy

* Transparent & Rule-Based: Portfolio construction mirrors the Nifty Private Bank Index methodology

* Low Cost: Passive structure offers an efficient way to gain exposure

* Accessible: Minimum investment of ₹1,000, with systematic investment options like SIPs and STPs available

* Non- Demat Holders : Will allow non demat account holders to seek exposure to private bank segment of the market

Scheme Details:

• NFO Period: July 1 – July 14, 2025

• Investment Strategy: Replicate the Nifty Private Bank TRI with a passive approach

• Exit Load: Nil

• SIP Amount – DURING NEW FUND OFFER PERIOD/ DURING ONGOING OFFER PERIOD:

Daily, Weekly, Fortnightly, Monthly SIP$: Rs. 1000/- (plus in multiple of Re. 1/-) Minimum installments: 6

Quarterly SIP: Rs. 1000/- (plus in multiple of Re. 1/-) Minimum installments – 4

• Benchmark: Nifty Private Bank TRI

• Fund Managers: Nishit Patel and Ashwini Shinde