GDP growth in FY26 to moderate amid global uncertainties: Ind-Ra

Ind-Ra expected a 100-125bp rate cut in the current easing cycle, with 100bp already implemented between February and June 2025. (Image: Freepik)

“Major headwinds are: i) uncertain global scenario from the unilateral tariff hikes by the US for all countries and ii) weaker-than-expected investment climate. The major tailwinds are: i) monetary easing, ii) faster-than-expected inflation decline, and iii) likely above-normal rainfall in 2025,” says Dr. Devendra Kumar Pant, Chief Economist and Head Public Finance, Ind-Ra.

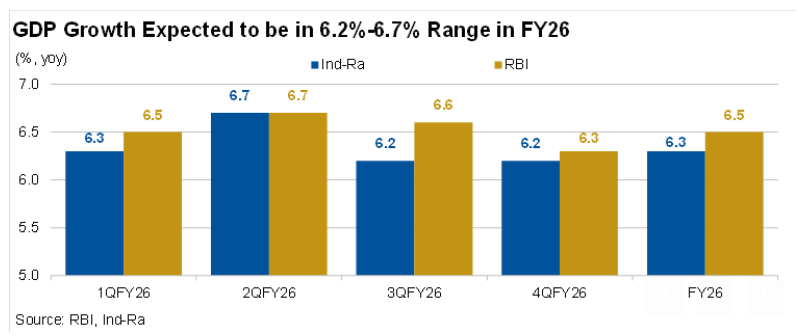

Ind-Ra while forecasting the FY26 growth at 6.6% (December 2024) assigned a key risk of tariff war and any capital outflow. There are downside risks to Ind-Ra’s growth forecast in view of the slowdown in global trade and demand and vice versa.

Strong Growth Tailwinds, though Unlikely to Offset Headwinds: Low inflation, monetary easing and so far favourable monsoons have brightened the scope for a continued economic recovery in FY26, and they are likely to minimise the impact of strong headwinds emanating from the uncertain global scenario. “While low inflation augurs well for consumption demand, monetary easing is likely to ease pressure on loan repayments, and better monsoon is likely to translate into brighter agriculture prospects, thus supporting rural demand. However, the combined impact of tailwinds is unlikely to fully alleviate the adverse impact of the strong headwinds,” says Paras Jasrai, Economist & Associate Director, Ind-Ra.

Uncertain Global Situation Major Headwind for Growth: Major growth drivers were expected to be monetary easing and capex. The pace of monetary easing in 2025 has been faster than our expectations. However, the tariff hikes by the US have increased the global economic uncertainty, leading to slower growth for both global demand and trade. This has led to investors adopting a wait and watch mode before taking decisions on greenfield expansion. The International Monetary Fund expects the global GDP to expand by 2.8% yoy in 2025 (April 2025 forecast) compared to 3.3% (January 2025 forecast) (2024: 3.3%), which is much below the historical average 3.7% (2000-2019). The World Bank has also cut its global GDP growth forecast for 2025 to 2.3% (June 2025) from 2.7% (January 2025) (2024: 2.8%). The global trade volume (goods and non-factor services) is forecasted to grow much slower at 1.8% in 2025 (June 2025 forecast) than 3.1% (January 2025 forecast) (2024: 3.4%). Commodity prices both energy and non-energy in 2025 are expected to remain lower than 2024. Energy prices are now (June 2025 forecast) expected to be lower than the January 2025 forecast. While the 2025 price forecast of non-factor services in June 2025 is higher than the forecast in January 2025, it remains lower than 2024. The World Bank expects these prices to remain subdued (lower than 2024) in 2026 and 2027 as well.

Consumption Demand to Remain Stable: Ind-Ra expects private final consumption expenditure (PFCE) to grow 6.9% yoy in FY26, consistent with its forecast (FY25: 7.2%) which was achieved on a low 5.6% growth rate in FY24. The stable PFCE growth forecast, despite a significant increase in FY25, emanates from a decline in retail inflation, leading to positive real wage growth for most categories of wage earners. Major factors affecting consumption growth include: i) low real wage growth, ii) decline in households’ savings, and iii) increase in personal loans. Real wage growth declined to 7.0% in FY25 from 12.6% in FY22, reducing the purchasing power of wage earners. The household savings rate too declined to 18.1% in FY24 from 20.1% in FY22. The sharp increase in personal loans since FY16 has reduced disposable income for consumption. The share of personal loans on usage such as medical expenses, weddings, and other discretionary spending purposes has increased to 25.9% during FY21-FY25 from 23.7% during FY16-FY20. The share of vehicle loans and credit cards has also increased to 11.6% and 4.6%, respectively, in the same period (FY16-FY20: 10.9% and 3.5%). All these items form a larger part of the upper income households’ consumption baskets. The recent consumption has relied on past savings and leveraged buyout. A sharp decline in inflation has improved the prospects for stable consumption growth in FY26.

Investment Growth to Slowdown: Ind-Ra expects investment demand, i.e. gross fixed capital formation (GFCF) to grow 6.7% yoy in FY26, slower than the forecasted 7.2% (FY25: 7.1%). Major reasons are: i) higher-than-expected investment growth in FY25 (7.1% vs a forecast of 6.7%), ii) weakness in manufacturing, and iii) sluggish global demand. The government investment demand was a major GFCF growth driver. Sectors such as telecom, chemicals and garment exporters may face a capex slowdown in FY26. Sectors such as oil and gas and real estate in metro areas are likely to have flat capex growth in FY26. Sectors such as power (thermal as well as renewables), transmission and distribution, logistics, warehousing may see continuation of capex growth momentum. Commercial and retail real estate are likely to see a continuation in capex in FY26 as well.

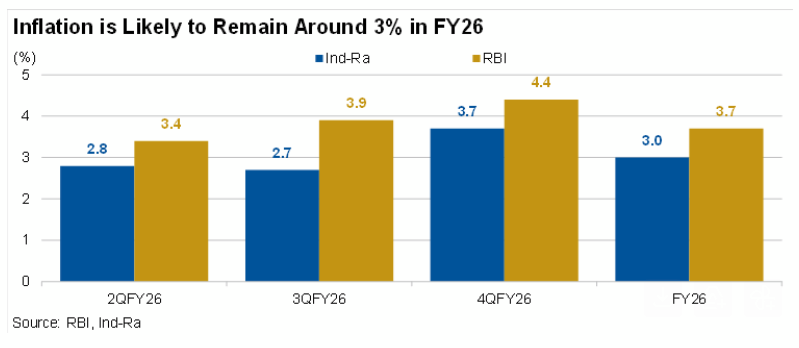

Inflation to Decline Significantly in FY26, Scope for Further 50bp rate Cut: Ind-Ra expects retail inflation to average 3.0% in FY26 as against a forecast of 4.3% (FY25: 4.6%). Retail inflation fell to a 77-month low of 2.1% in June 2025, staying below the 4% mark (RBI’s inflation target) for the fifth consecutive month. The drop was due to a sharp fall in food inflation to negative 1.1% in June 2025 from 10.9% in October 2024. Core inflation, which remained between 3%-4% during December 2023 to February 2025, gradually increased to 4.43% in June 2025. Better-than-normal rainfall and benign global commodity prices are keeping inflation in check.

Ind-Ra expected a 100-125bp rate cut in the current easing cycle, with 100bp already implemented between February and June 2025. The inflation decline has exceeded the RBI’s and market expectations. To encourage savings, the real repo rate must be positive, with 125-150bp previously considered significant. With the inflation projected to average 3.0% in FY26, a substantial near-term monetary easing by the RBI seems unlikely. The inflation outlook for FY27 and beyond will influence the RBI’s decision on rate cuts. Ind-Ra believes there is scope for an additional 50bp rate cut in the current cycle. Also, a CRR cut and expected monetary easing of up to 150bp will be significant for maintaining stable economic growth.

Current Account to Remain Stable, Some Deterioration in Basic External Balance: Ind-Ra expects slower growth in both goods exports and imports for FY26, with the trade balance at USD325.1 billion (FY25: USD287.2 billion). However, a services surplus and buoyant remittances are expected to limit the current account deficit from increasing significantly. Ind-Ra expects net services exports to grow 10% yoy to around USD210.0 billion in FY26, down from 16.0% in FY25. The current account deficit is expected to be 0.9% of GDP in FY26 (FY25: 0.6%). The basic external balance – current account + net FDI is expected to deteriorate further to negative USD34.5 billion in FY26 (FY25: negative USD22.4 billion). The currency (INR/USD) is likely to depreciate 2.8% in FY26 (FY25: 2.2%).