Homebuyer affordability improves in 2025 as interest rates fall: Knight Frank India

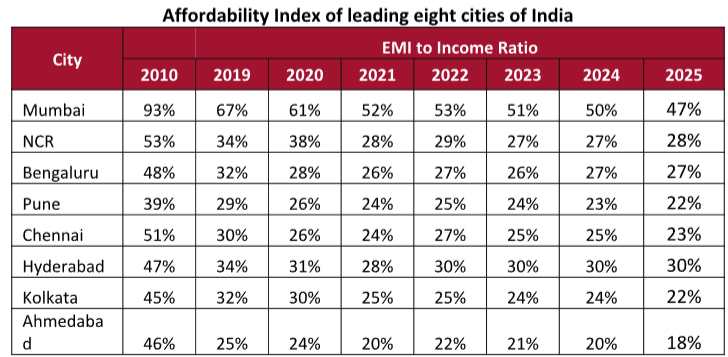

Ahmedabad emerged as the most affordable market with an EMI-to-income ratio of 18%, followed by Pune and Kolkata at 22%.

Affordability levels in NCR remain well within acceptable limits and continue to be significantly better than the 50% threshold that signals market stress. (Image: Freepik)

Homebuyer affordability improved across seven of India’s eight major housing markets in 2025, aided by a sharp decline in home loan interest rates, according to Knight Frank India’s Affordability Index. The report shows that the RBI’s 125 basis point repo rate cut since February 2025 has significantly eased EMI burdens, pushing affordability ratios lower across key cities. Ahmedabad emerged as the most affordable market with an EMI-to-income ratio of 18%, followed by Pune and Kolkata at 22%.

Notably, Mumbai breached the affordability threshold for the first time, with the ratio improving to 47%, signalling a structurally healthier housing market. NCR was the only region to see a marginal deterioration, driven by strong price appreciation in the premium segment, though affordability levels remain within sustainable limits.

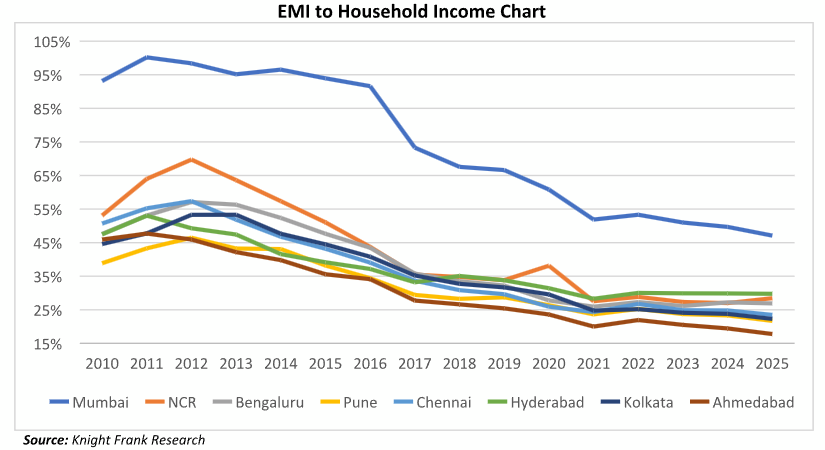

Knight Frank India’s Affordability Index, which measures the proportion of household income spent on EMIs, showed a consistent improvement across the eight major Indian cities between 2010 and 2021. Affordability strengthened further during the pandemic as the Reserve Bank of India (RBI) lowered the policy repo rate to decade lows.

However, in response to elevated inflation, the RBI increased the repo rate by 250 bps over a nine-month period beginning May 2022, which led to a temporary deterioration in affordability during 2022. Rate stability from February 2023 onward supported a gradual recovery in affordability conditions. More recently, with economic growth remaining resilient and inflation easing materially, the RBI has reduced the repo rate by 125 bps since February 2025, resulting in a further improvement in affordability across most housing markets. This supportive rate environment has helped residential sales sustain close to the post-pandemic peak recorded in 2024.

Source: Knight Frank Research. Note: For H2 2025, affordability and income levels are calculated keeping all variables constant, except for the interest rate.

Shishir Baijal, International Partner, Chairman and Managing Director, Knight Frank India, said, “Supportive affordability is essential for sustaining homebuyer demand and sales momentum, which in turn acts as a key economic driver for the country. Over the past few years, both weighted average prices and income levels have risen, even as home loan interest rates have followed the repo rate trajectory which has declined 125 bps this year. Among these three critical parameters influencing affordability, income levels have improved at a faster pace, and in tandem with the reducing interest rates, has strengthened overall home affordability. As income levels rise and economic growth gains traction, end-users’ financial confidence is significantly reinforced, encouraging them to undertake longer-term financial commitments towards asset creation. Given the RBI’s robust GDP growth estimate of 7.3% for FY2026 and a benign interest rate environment, affordability levels are expected to remain supportive of homebuyer demand in 2026.”

The COVID-19 pandemic became a catalyst for the residential real estate market, triggering a recalibration of both property prices and lending rates that significantly boosted demand. This residential market momentum has persisted, supported by strong economic factors such as effective inflation control, and continued economic growth, which has improved home affordability and catapulted residential sales. Entering 2025, concerns around excessive market heating and the possibility of a sharp correction began to emerge among stakeholders. However, sales activity has remained close to the highs recorded in 2024 and the market is on track to close the year without any material disruption.

Mumbai breaches affordability threshold for the first time; affordability worsens in NCR

The affordability level in Mumbai has improved significantly since the pandemic and has crossed over the affordability threshold of 50% in 2025. A stable business and income growth environment coupled with reasonable price growth and increasingly enabling financing environment were the major causal factors behind this improved affordability. In contrast, the NCR was the only major market to register a deterioration in affordability during the year, driven by a sharp rise in weighted average prices due to heightened activity at the premium end of the market. Even so, affordability levels in NCR remain well within acceptable limits and continue to be significantly better than the 50% threshold that signals market stress.

Home affordability in Bengaluru and Hyderabad markets remained unchanged as both demand as well as weighted average values saw improvement over the year. Here too affordability well below the threshold keeping these markets buyer friendly.