Festive cheer seen supporting housing demand despite rising prices

In the mid-term, the housing market is positioned for continued growth, supported by stable monetary policy, government initiatives promoting homeownership and strong underlying demand.

The NCR has cemented its position as India's top-performing housing market, leading with an exceptional annual growth of 42 points in Q2 2025. (Image: Freepik)

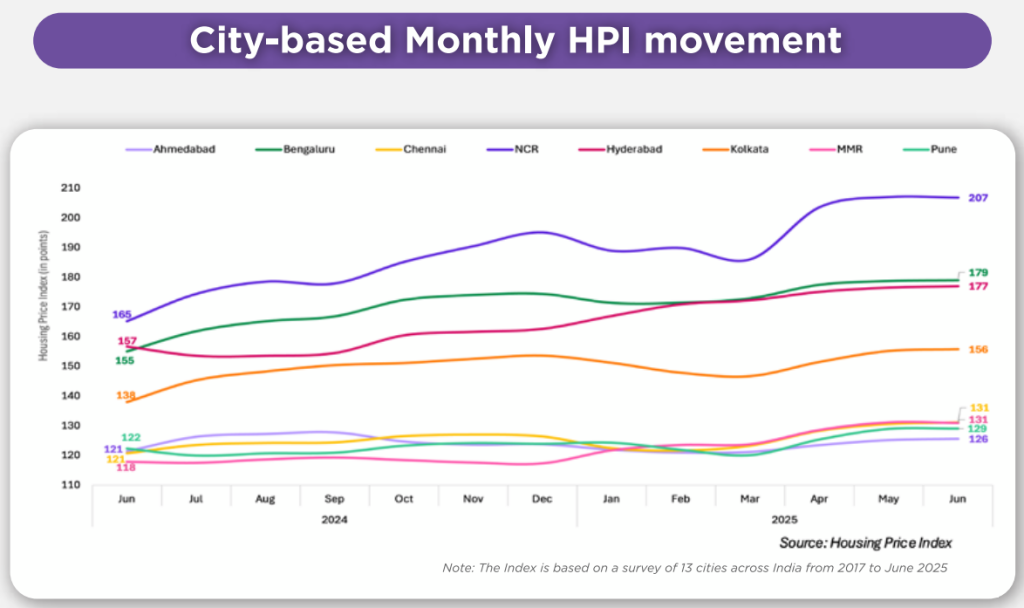

The All-India Housing Price Index (HPI) for 13 cities showed a 14-point jump in June despite signs of demand moderation in the country’s second-largest employment generating sector, according to a report by REA India and Indian School of Business (ISB). The Index also saw a sharp 8-point sequential jump, underlining the momentum in price growth, the report said.

The Housing Price Index (HPI), a joint initiative by India’s leading digital real estate platform Housing.com, owned by REA India, and the Indian School of Business (ISB), tracks housing trends across 13 major cities: Ahmedabad, Bengaluru, Chennai, Faridabad, Gandhinagar, Ghaziabad, Greater Noida, Gurugram, Hyderabad, Kolkata, Mumbai, Noida, and Pune.

“Short-term pressures from trade uncertainties notwithstanding, India’s housing sector will continue to garner both attention and attraction as it gradually attains more maturity. While cost concerns do persist requiring government intervention, some positive changes are already visible. The Goods and Services Tax reforms, for instance, are expected to improve affordability, supporting demand, especially in the mid-segment, a category that must perform well for India to fulfil its housing-for-all dream,” said Praveen Sharma, CEO, Housing.com.

Shekhar Tomar, Assistant Professor of Economics and Public Policy at ISB, pointed out that in terms of pricing signs of relative stability were visible during the June quarter.

“India’s housing market showed resilience in Q2 2025, with demand particularly strong in the high-ticket 3BHK segment across NCR, Hyderabad and Bengaluru. While year-on-year prices remain higher, Q2 witnessed relative stability, suggesting a short-term moderation. With the 100-basis point repo rate cut in the first half of 2025 and inflation under control, we expect demand momentum, especially for larger homes in metropolitan regions, to continue driving the market in the coming quarters,” said Tomar.

Regional highlights

The NCR has cemented its position as India’s top-performing housing market, leading with an exceptional annual growth of 42 points in Q2 2025. The region’s outstanding performance stems from robust investor confidence, strong job creation in key sectors, and continued preference for premium residential corridors. Both 2BHK and 3BHK segments have shown remarkable traction, with most demand concentrated in Noida, Greater Noida and Gurugram markets.

Maintaining its status as a key growth center, Bengaluru secured second position with a 24-point YoY jump in reading. Driven by an influx of IT professionals, this market has shown balanced growth across configurations, with premium segments leading the pack. Areas like Bengaluru South, Outer Ring Road and other prime localities have contributed significantly to this growth.

Hyderabad emerged as the third-highest performer, with a 20-point annual jump, reflecting the city’s consistent growth trajectory. The market benefits from strong demand across multiple sub-markets, with localities in ORR West, Hyderabad West and other prime areas witnessing substantial appreciation.

MMR continues to attract substantial interest despite being India’s costliest housing market, with demand concentrated in the luxury and ultra-luxury segments. The city’s limited land availability and high replacement costs continue to support price appreciation.

Kolkata registered noteworthy HPI growth, reflecting the city’s emerging appeal among buyers seeking value and improved lifestyle amenities. The market shows strong preference for compact configurations aligned with local affordability dynamics.

Configuration and Segment Trends

The luxury housing segment continues its strong performance trajectory, with sustained demand from HNIs, NRIs and entrepreneurs. This segment benefits from wealth creation in India’s expanding economy and the desire for premium lifestyle amenities.

Larger homes (3BHK and above) remain highly sought after in metro markets, reflecting post-pandemic space requirements and evolving lifestyle preferences. However, tier-2 cities continue to show strong preference for smaller, more affordable configurations, creating a well-balanced demand distribution across the country.

Market Outlook for 2025-26

Concerns of affordability along with the recent imposition of US tariffs on Indian exports is likely to cause further strain on home sales in the September quarter, the report points out.

However, in the mid-term, the market is positioned for continued growth, supported by stable monetary policy, government initiatives promoting homeownership and strong underlying demand.

The exceptional performance of NCR, Bengaluru and Hyderabad, positions these markets for sustained expansion. However, affordability pressures in major cities, particularly for mid-income buyers, remain a key challenge due to rising construction costs and income growth disparities. Addressing these concerns through targeted policy interventions and innovative financing solutions will be crucial for sustaining long-term market health.

The stable repo rate environment and supportive government policies continue to provide a favorable backdrop for homebuyers, with financing costs remaining manageable despite rising property prices. This balance between growth and accessibility will be essential for the market’s continued evolution.