ICRA sees residential sales dip 0–3% in FY26 amid affordability pressure

A material rise in the average selling prices (ASP) of residential units by more than 10% annually from FY2023 to FY2025 continues to pose a drag on affordability of buyers.

Notwithstanding the slowdown in broader market, the traction in the luxury segment continues in the current fiscal as well, with its share in total sales increasing to 34% in Q1 FY2026 from 30% in FY2024. (Image: Freepik)

Rating agency ICRA expects the residential real estate sector to remain in a stabilising phase in FY2026. A material rise in the average selling prices (ASP) of residential units by more than 10% annually from FY2023 to FY2025 continues to pose a drag on affordability of buyers.

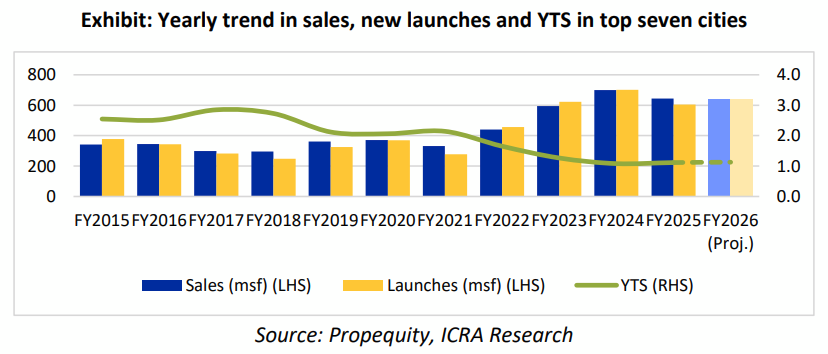

Owing to this, as well as expected moderation in sales velocity, ICRA projects the area sold in the top seven cities in India to decline by 0-3%, reaching 620-640 million square feet (msf) in FY2026. Following a 14% decline in FY2025, ICRA estimates launches to increase by 4-7% to 630-650 msf in FY2026 across the top seven cities. This is likely to be supported by the spillover from the previous year and the current comfortable unsold inventory levels.

Following a period of robust growth in residential sales at a CAGR of 26% during FY2022-FY2024, the residential real estate sector had entered an equilibrium phase in FY2025, which is expected to continue in FY2026. The area sold saw a decline of 8% to 643 msf in FY2025 due to a sharp contraction in launches along with moderation in sales velocity, primarily in affordable and the mid segment. While the area sold in the luxury segment increased by 6% during FY2025, it declined by 14% and 10% in the affordable and mid segment respectively. This trend continued in Q1 FY2026 with the YoY contraction in sales and launches by 4.6% and 4.1%, respectively.

Notwithstanding the slowdown in broader market, the traction in the luxury segment continues in the current fiscal as well, with its share in total sales increasing to 34% in Q1 FY2026 from 30% in FY2024.

Giving more insights, Anupama Reddy, Co-Group Head & Vice President– Corporate Ratings, ICRA, said: “The calibrated launches by developers helped in maintaining a comfortable inventory level, despite moderation in sales momentum in the broader residential market. Consequently, the years-to-sell (YTS) metric is estimated to remain healthy at 1.0-1.1 times by March 2026. The ASP rose by 16% in FY2025 and is projected to further increase by 6-8% in FY2026. This is being driven by the increasing share of the luxury segment, low inventory overhang and comfortable YTS and consolidation in the industry with better pricing power for the prominent listed developers.”

Policy reforms such as the GST, the Real Estate Regulatory Authority (RERA) compliances have brought about a structural shift in the industry and has accelerated the pace of consolidation in the sector while adversely impacting weaker entities. Further, players with huge slippages in the project execution have faced penalties in the RERA and other litigations, resulting in the ceding of market share to reputed developers.

Commenting on the consolidation in the sector, Reddy said: “The share of key listed developers increased to around 20% of the total sales value in FY2025 from 13.1% in FY2020. This shift reflects growing buyer confidence in reputed developers, particularly during the under-construction phase, driven by their strong track record and timely project delivery. Industry consolidation is expected to persist over the medium term, with prominent listed players likely to outperform broader market trends.

“These developers have substantially deleveraged over the past 2–3 years, supported by robust sales, healthy collections, and strong operating cash flows. While debt levels may see a moderate uptick in FY2026 to fund construction and growth initiatives, the leverage position is expected to remain comfortable, backed by steady growth in collections, committed receivables, and ongoing construction progress. Overall, the outlook on the residential real estate sector remains Stable,” he added.